Employment lawyers

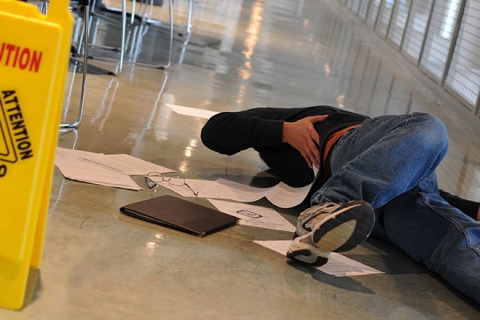

If you’re in need of a competent, reassuring team of employment lawyers or personal injury lawyers, you’re in the right place. We are comprised of highly-educated, experienced, and aggressive sexual harassment lawyers, wage and hour lawyers, age discrimination lawyers, and personal injury lawyers. Committed to our clients’ claims, we offer free consultations and evaluations which are always conducted with an assurance of absolute privacy. We will never contact your employer or other individuals when consulting about your case. To learn more about our practice areas, select an item from the options below.